Prime

Parliament approves loans, Shs5.2t supplementary budget

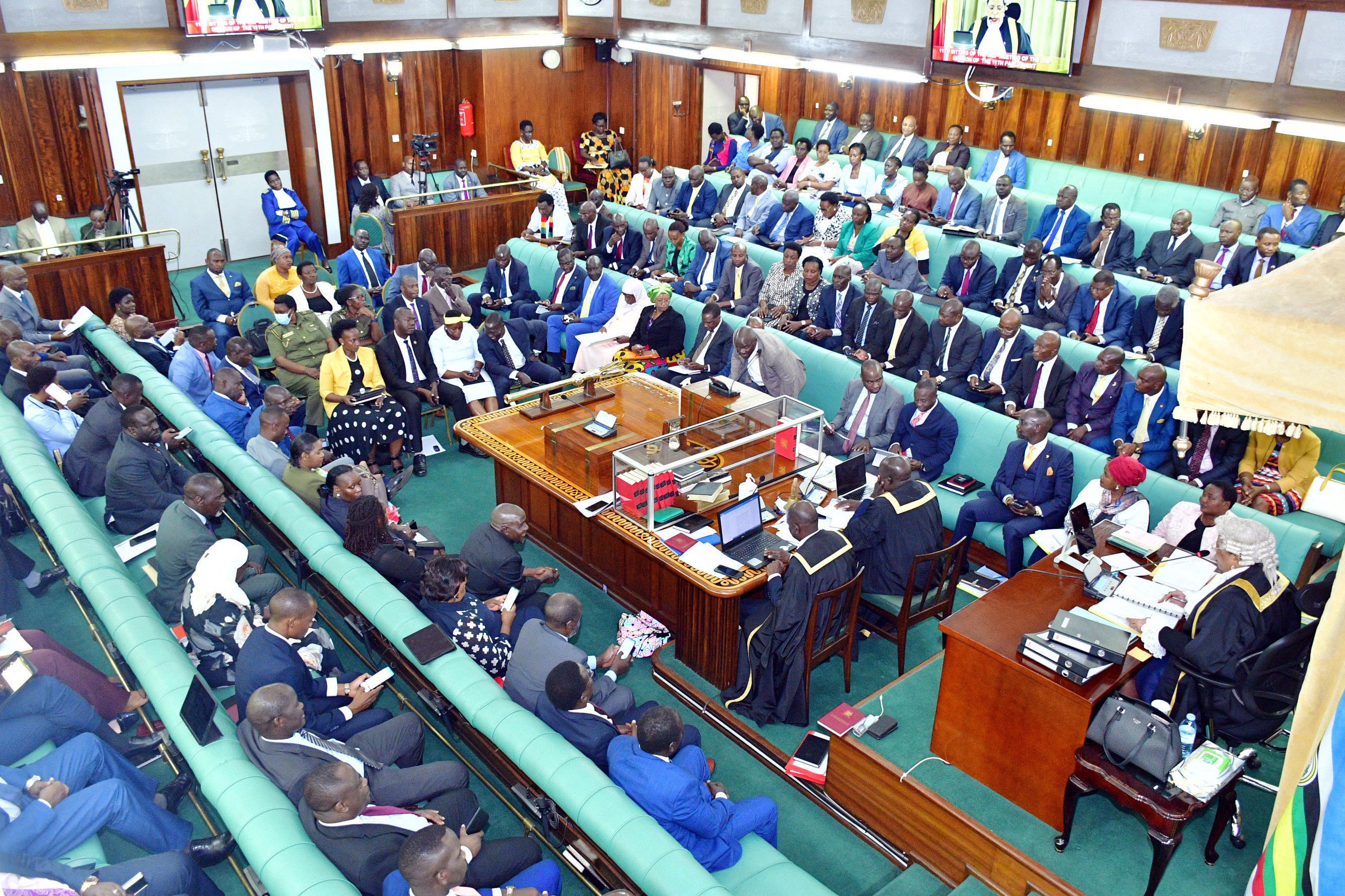

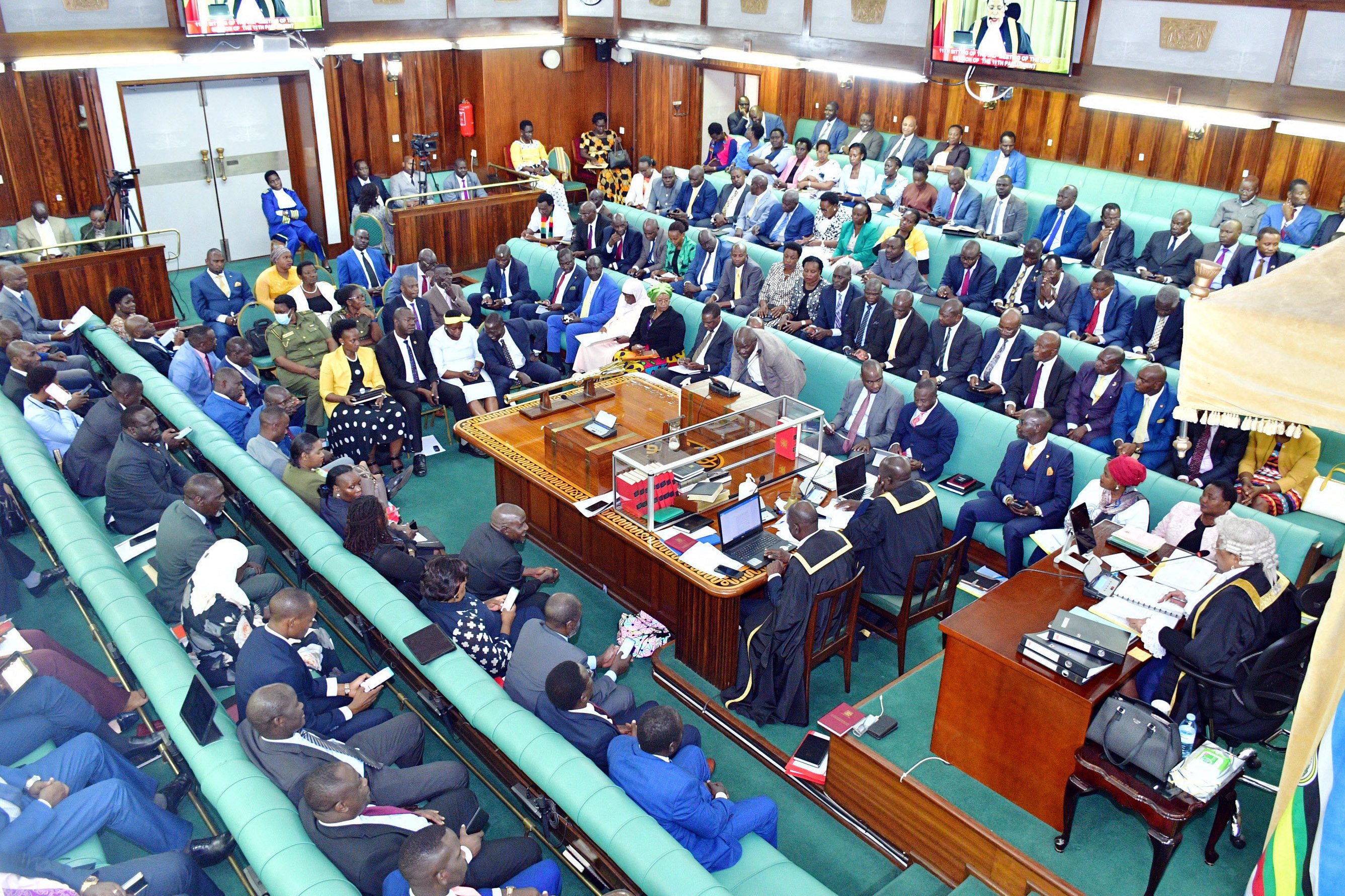

Members of Parliament during the plenary session at Parliament on February 28, 2023. PHOTO | DAVID LUBOWA

What you need to know:

- The latest loan requests push the country’s debt further, which by the end of August 2023 stood at over Shs88.80 trillion, further plunging the country into a debt crisis.

Parliament of Uganda on Wednesday approved three loans amounting to over Shs5.2 trillion including; Shs3.5 trillion from local commercial banks to fund the supplementary budget, Shs1.227 trillion from World Bank for smart agriculture and Shs554.689 billion from China to finance the e-government infrastructure project phase.

The latest loan requests push the country’s debt further, which by the end of August 2023 stood at over Shs88.80 trillion, further plunging the country into a debt crisis.

The majority of NRM legislators led by the Speaker of Parliament, Anita Among brushed aside resistance put up by the opposition MPs and allowed the entire amount to be passed.

“The Committee recommends that the proposal to borrow up to Shs554.689 billion from the Export-Import Bank of China to finance the supply, installation, commissioning and support of the National Data Transmission Backbone Infrastructure/E-Government Infrastructure Project Phase V, be approved subject to the recommendations herein,” the committee report reads in part.

In the same vein, the committee also recommended the approval of $325 for the climate-smart agriculture project without a hitch.

“The Committee, therefore, recommends that the request by the government to borrow up to USD 325 million and receive a grant of up to SDR 19.5 million (equivalent to Shs1.227 trillion) from the International Development Association (IDA) of the World Bank Group to finance the Uganda Climate Smart Agricultural Transformation Project (UCSATP), be approved subject to the recommendations herein.”

However, the opposition members put up a fight when it came to the request to borrow Shs3.5 trillion to finance the supplementary budget, arguing that some of the money the government was planning to borrow was already available and saw no reason for borrowing.

The government had tabled a supplementary request of Shs1.9 trillion for approval by parliament before spending and another Shs1.56 trillion within the 3 per cent limit authorized by the law.

However, while the Shs1.56 trillion had already been spent and brought to parliament for retrospective approval, the government in its request to borrow included the same amount.

“I request the House approves the Supplementary Expenditures under Schedule No.1, for FY 2023/24 totalling Shs3.5 trillion as outlined of the proposed Supply Schedules together with an amended funding source of Non-Tax revenue of Shs28. 700 billion, External Financing of Shs322.163 billion, Local Revenue of ShsX 0.433 billion and borrowing from Domestic Market of Shs3,141.628 billion,” the majority committee report stated.

However, Muwanga Kivumbi, the Shadow Minister of Finance accused the government of spending in anticipation, which he said is a financial indiscipline.

“You cannot borrow when part of the money is already within. Our departure from the majority report is that while the government sought to revote money that was swept back at the end of the last financial year, which is already available, it is again going to borrow the same money which it has. How possible is this?” he questioned.

In the minority report, the committed faulted the government for financial indiscipline which they said if not checked would lead to disaster.

The government side rubbished this argument, saying the money that was swept back at the end of the last financial year is not available and what the government is seeking is new money, which it will borrow. And the majority voted in favour.

The minority report said this gives leeway to the government to spend the taxpayers’ money with impunity and commit the country to further debt distress. They particularly took issue with the statehouse that over the years has been the biggest beneficiary of the supplementary budget.