Prime

Three more remanded in Equity Bank fraud case

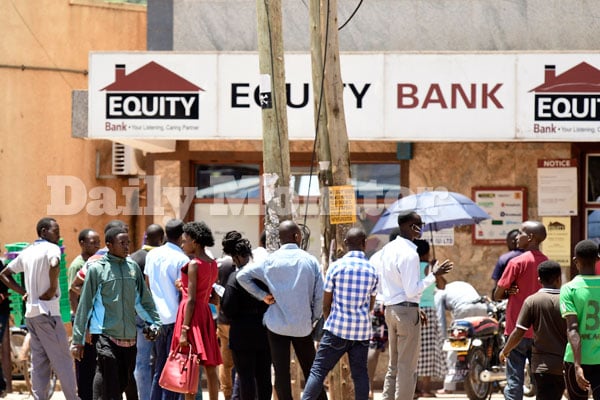

People line up to withdraw money at an Equity Bank ATM in Kabalagala along Ggaba road, Kampala recently. PHOTO/ FILE

What you need to know:

- All three of the accused were not allowed to plead to the charges.

Three more people, among them a former employee of Equity Bank, have been remanded in connection with the alleged fraud regarding loss of billions of shillings in unsecured loans from Equity Bank.

Others remanded include two former employees of Airtel Uganda, who are now businessmen. They have been named as Godfrey Mukwaya and Robert Mugumya. Also in the crosshairs is Fred Kato, a former head of Small and Medium Enterprises at Equity Bank.

The trio was arraigned before the Magistrates Court of the Anti-Corruption Division on accusations of conspiracy to defraud. All three of the accused were not allowed to plead to the charges.

It is alleged that Mr Mukwaya, a former sales manager at Airtel Uganda, used different people to open up bank accounts through which the bank was defrauded more than Shs10b.

The state further alleges that Mr Mugumya is linked to 179 fictitious companies that were created to defraud Equity bank using different persons to obtain more than Shs35b.

Justifying his reason not to allow the accused persons to plead to the charges, Mr Albert Asiimwe, the presiding magistrate, reasoned that they are joined on the case file involving money laundering that is triable by the High Court.

“While this court has powers to handle the case of conspiracy, this one is emanating from money laundering. I advise that you will plead to the charges in the High Court, which has powers to entertain all the cases,” Mr Asiimwe held.

The charging of the three brings to eight, the number of suspects in connection with alleged unsecured loans worth more than Shs62b from Equity Bank.

On March 20, 2024, five people, among them employees of Equity Bank, had a money laundering charge slapped on them in regard to disbursement of Shs62b of unsecured loans to unqualified persons.

The five suspects were arraigned before the Anti-Corruption Magistrates Court on charges of obtaining credit by false pretence, money laundering, and conspiracy to defraud.

They include Mr Julius Musiime, the head of agency banking at Equity Bank; Ms Erina Nabisubi, a relationship manager for telco; Mr Fred Semwogerere, a banker; Mr Cresent Tibarwesereka, a relationship officer; and Wycliff Asiimwe, a distribution and marketing consultant with a microfinance facility.

Prosecution alleges that between 2021 and 2024, at Equity Bank, in Kampala City, Ms Nabisubi, being a person employed as a relationship manager in charge of telecom, incurred a debt of Shs6.55b from Equity Bank. She allegedly pulled this off by falsely claiming that the loans were being applied for by Gladys Najjemba, who she fronted as having fulfilled the bank requirements for accessing the loans whereas not.

The state contends that Ms Nabisubi also incurred a debt of Shs300m from Equity Bank by falsely representing that the loans were being applied for by Latiffa Nagawa.

The latter was reportedly fronted as having fulfilled the bank requirement for accessing the loans whereas not. It is alleged that between 2021 and 2024 at Equity Bank headquarters, situated at Church House in Kampala, Ms Nabisubi intentionally impeded the establishment of the true ownership of Shs6.5b which she fraudulently obtained from Equity Bank as loan through account number 1032100370335 in the name of Gladys Najjemba. The accused reportedly claimed that the said funds were applied for by Najjemba as a loan, not knowing that the said funds were proceeds of crime.

The state further alleges that Mr Musiime intentionally concealed the true ownership of Shs18m, which he received as gratification from Stella Mutuuza.

The reward was for having allegedly fraudulently processed a loan of Shs700m from Equity Bank by requiring Mutuuza to deposit the said gratification on the account number 1013101211316 in the name of Gilbert Rwaiheru Kiiza. This was all done, the state adds, well knowing that the said deposits were proceeds of crime.