Prime

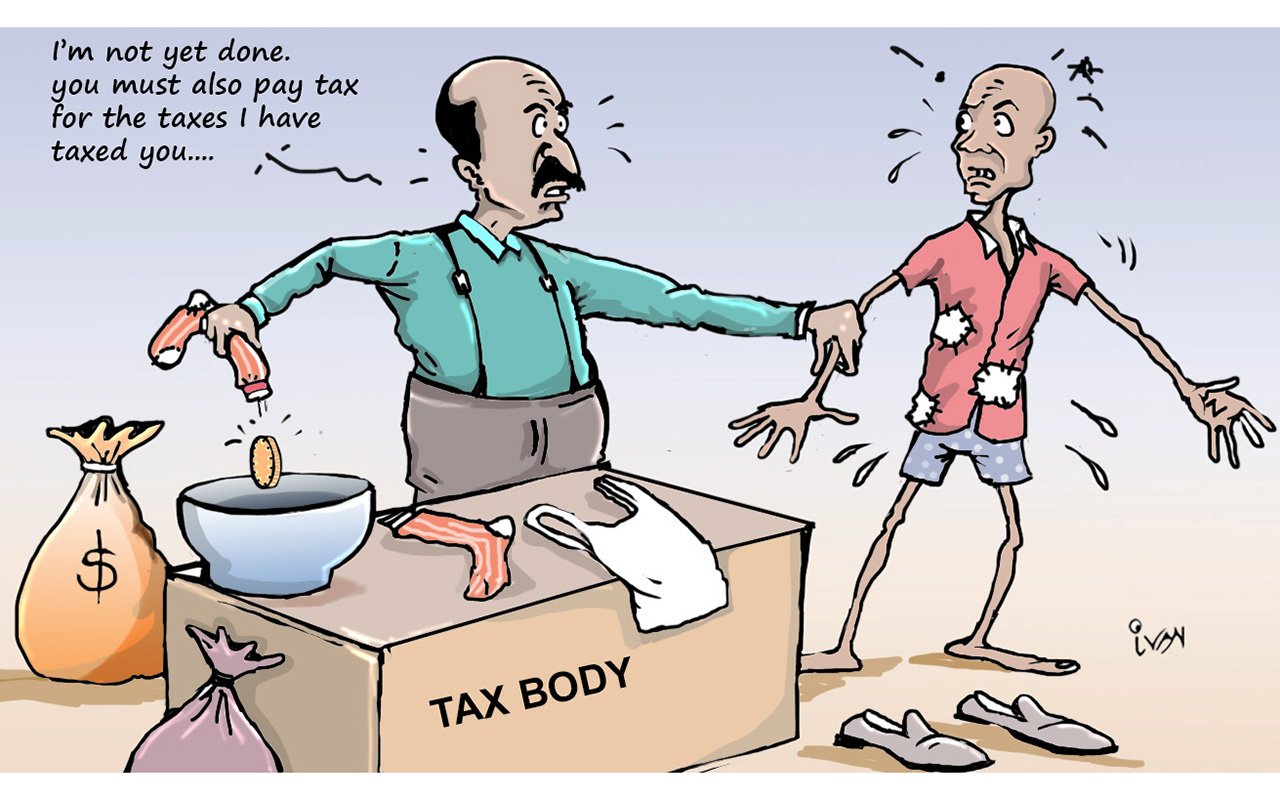

URA’s tax enforcement methods are choking taxpayers

Brian Mukalazi

What you need to know:

- Do not wait for URA to pounce: Strengthen your business processes and governance systems.

About two months ago, I was approached for tax advice by an 80-year-old client whose life was almost cut short over an income tax assessment he had previously received from the Uganda Revenue Authority (URA).

The old man, filled with deep fear, wondered how URA could penalise him close to Shs40 million when he always endeavoured to adequately file his tax returns as well as making timely payments. He pondered how his meagre retirement income would support payment of such an outrageous amount.

Dissatisfied with the tax assessment, we opted to lodge an objection, clearly specifying the grounds for the same. However, as we waited for the objection decision from URA, several of its officers, in an uncoordinated fashion, continued making threatening phone calls, sending strongly-worded text messages and emails to the client, demanding for urgent payment of the assessed tax.

These events greatly unsettled my client and he feared that his property would be seized. But after a series of long, stressful meetings, a difficult resolution was recently reached: the tax liability was revised to about Shs20 million and he was given less than three months to settle it. He is now fundraising money from his children and other family members!

The above predicament is just one of the many experienced by Ugandan taxpayers at the hands of URA.

For instance, the on-going stand-off between URA and Kampala traders is partly attributed to the tax enforcement methods which the traders consider excessive and unfair.

It has become a common occurrence for URA enforcement teams, in company of armed security personnel, to intercept and confiscate in-transit merchandise over Electronic Fiscal Receipting and Invoicing Solution (EFRIS)-generated receipts. Many vendors don’t even understand what EFRIS is - no wonder majority think it is a tax.

Other taxpayers have had their businesses closed in dehumanising ways. One supermarket manager in Soroti District described his ordeal as follows: “The enforcement team surrounded the counter while others rushed behind the shelves to push customers out of the supermarket, they told us we had tax arrears to pay. We were all shocked, we thought we had been raided by armed robbers dressed in military uniform because they had not introduced themselves and some of our clients ran behind the shelves to take cover in fear before they were all pushed out of the supermarket”.

I am against tax evasion and anyone found guilty of the same should be apprehended. But my plea is for those taxpayers disadvantaged by genuine economic circumstances such as cashflow difficulties and tax illiteracy.

These deserve lenience and an opportunity to turn their fortunes around. And in all this, URA should not miss the big picture.

Closing someone’s business could mean loss of credibility, customers, revenues and employees. And the ultimate result could be the total business collapse and failure to pay the outstanding tax obligations. This is a lose-lose situation for everybody.

I will end with these two recommendations. First, to the taxpayer: Tighten your belts and expect more encounters with URA. But the best way of managing these encounters is to prevent them in the first place. Do not wait for URA to pounce: Strengthen your business processes and governance systems. Maintain proper records. File and pay your taxes on time. And seek professional advice.

To URA: Take a step back and reflect. Appreciate that the economy is currently in a free-fall and everyone is struggling. Engage and extensively educate the taxpayers - tax literacy levels are still too low.

Mr Brian Mukalazi is the CEO, Talis Consults Ltd.