Shs330 billion hidden in a foreign bank abroad should be invested here- Gov't

Graphic by Christian Aid

Developing countries like Uganda suffer the brunt of stashing money in foreign banks abroad much more than nations with bigger economies, a new report called SwissLeaks Reviewed, has disclosed.

It further emerged that the practice of stashing money in foreign banks is higher in developing countries than it is the case with the wealthy nations with bigger Gross Domestic products (GDP).

GDP is the total value of goods and services produced in a country at a particular period—normally annually.

According to an analysis of a leaked HSBC Swiss account information, at least Shs330 billion originating from Uganda is being held in a Swiss bank known for its tendencies to abet tax evasion and illicit financial flows (IFFs). This money, according to the analysis could be as a result of illegal activities such as illicit financial flows and tax evasions, currently bleeding the African continent to near death.

A joint statement, issued by Financial Transparency Coalition and Christian Aid, quoted the Senior Economic Advisor at Christian Aid, Mr Joseph Stead, as saying that tax haven banks like HSBC Switzerland are hiding proportionally a much larger amount of money, and potentially depriving developing countries of significant, desperately needed tax revenues.

Studies indicate that Uganda alone loses $509million (nearly Shs2rillion) as a result of tax evasion and illicit financial flows while Africa as a continent is robbed of $1trillion annually to this illegal activity.

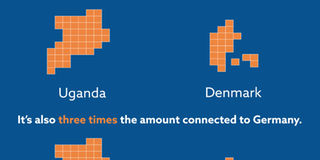

The analysis done by the Financial Transparency Coalition and Christian Aid, shows that this sum of money stashed just in one foreign bank, HSBC, is almost double the amount connected to Denmark whose GDP of $335billion is nearly 16 times that of Uganda.

The same amount which is nearly an equivalent of the budget allocated to the Ministry of Agriculture also translates into three times the amount connected to Germany whose economy has a bigger GDP ($3.73 trillion) than that of Uganda estimated at $21 billion (aboutShs80 trillion).

The findings of the analysis launched on Wednesday, state that while all the focus is geared towards the amount of money countries are hiding from places like the US, UK, France and Spain, SwissLeaks reviewed, the joint project of Christian Aid and the Financial Transparency Coalition, re-examined the SwissLeaks data as a percentage of a country’s GDP. And the results were staggering.

“Because the totals aren’t huge, no real attention has been paid to the cash from developing countries in HSBC Switzerland, yet proportionally Senegal has nearly three times as much in the Swiss bank as France, and more than 10 times as much as Germany. “Similarly outsized proportions run true for many developing countries,” Mr Stead was quoted as saying.

He added: “And for that, we shouldn’t be ignoring this, and neither should the G20 (informal group of wealthy economies with representatives from the International Monetary Fund and the World Bank.”

Campaigners say the evidence strengthens the urgent need for developing nations to know about their citizens’ foreign bank accounts, although it looks certain that this is a move that the G20 Finance Ministers are unlikely not to consider in their upcoming meeting due this month.

The Swissleaks project, analysed by the Financial Transparency Coalition and Christian Aid, followed the International Consortium of Investigative Journalists (ICIJ) perusal of more than 100,000 leaked bank accounts from HSBC Switzerland.

As a result, the project which involved dozens of journalists from across the world laid bare the fact that developing countries like Uganda are hiding away more money in foreign banks abroad compared to wealthy countries.

A close examination of the stashed amounts in relation to the developing country’s GDP, makes it clear that in real terms, developing countries are the victim. This makes it more interesting, considering that it would make more sense if it was the other way round—richer countries hiding more money in foreign banks.

In an interview on Wednesday, the Secretary to the Treasury and also Ministry of Finance Permanent Secretary, Mr Keith Muhakanizi, said for Uganda’s case, the amount of money involved (Shs330 billion) is not an alarming figure compared to the population of the country.

“I don’t like Ugandans stashing money away because that (money) should be invested in the economy here and not in a bank abroad. However, I think that is a small figure. If it were bigger than that then I would be worried. That is not very alarming.”

Way forward

According to SwissLeaks Reviewed project—report, It is difficult to quantify just how much increased revenue a particular country could realise if the citizen’s money was not stashed away.

But some countries, like Spain, have begun to provide information on how much in taxes and fees they've already started to recoup from the leaked HSBC Swiss accounts.

Spain has said it has recovered roughly $340 million from its citizens' accounts, roughly 15 per cent of the total amount linked to the country in the leaks, something Uganda and other developing countries can experiment.

The goal of automatic exchange of financial information between governments is laudable in addressing this problem, but according to Mr Stead, requirements of the OECD (club of wealthy countries) system will end up acting as barriers to developing countries inclusion.

Worth noting, however, is that “ICIJ’s SwissLeaks investigation was monumental to the broader discussion on illicit flows and tax evasion, but much of the initial media coverage centered around money in places like the U.S., France, and Spain,” said Christian Freymeyer, Press & Digital Media Coordinator for the Financial Transparency Coalition.

He continued: “We wanted to use the same data, but visualize it differently, to help demonstrate the scale of the problem for developing countries, and why the fact that they don’t have a say in the global standard setting process is cause for concern.”