Prime

Airtel, GnuGrid build solution to determine credit worthiness of mobile money borrowers

Mr David Opio Obwangamoi, speaks during the launch of the Mobile Credit Score solution in Kampala on Wednesday. Photo / Courtesy

What you need to know:

- The Mobile Credit Score solution track credit worthiness of mobile money users, which is key in the extension of micro loans to subscribers

Airtel Mobile Commerce Uganda, the Fintech division of Airtel in partnership with GnuGrid, a credit reference bureau firm, will now be able to track credit worthiness of mobile money users, which is key in the extension of micro loans to subscribers.

The system, which will be implemented through the Mobile Credit Score solution, was unveiled in Kampala on Wednesday and will also support development of a mobile credit scoring system to enable micro lenders monitor borrower risk profiles.

They solution will initially develop a mobile credit score for every Airtel Money account to enhance user reputational collateral as well as determine growth of user financial responsibility and trustworthiness.

Mr David Opio Obwangamoi, the GnuGrid founder and chief executive officer, said at the launch that the solution will not only ease extension of micro loans but will help to build confidence in the micro loans ecosystem.

“ ... we are not just facilitating loans, we are building a foundation of trust within the financial ecosystem.,” he said.

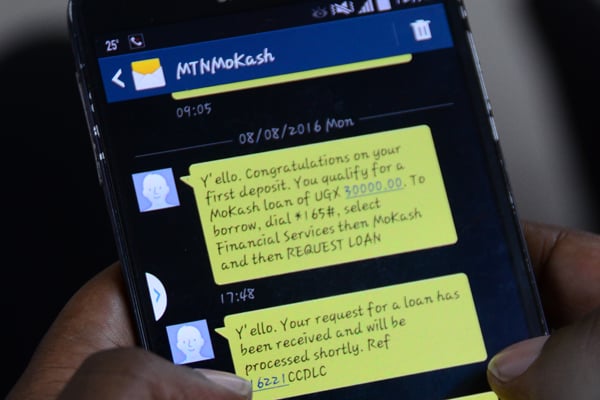

Mobile money loans have grown into some of the most influential products in the financial markets with Ministry of Finance data indicating that at least Shs31.5b worth of loans is advanced to mobile money borrowers every month.

Telecoms currently rely on behaviourial trends of a subscriber to determine how much they can draw out.

The Mobile Credit Score solution will as well be a key determinant in lobbying lower interest rates, especially for borrowers who make timely repayments, while at the same time user data will be shared with other lenders in Uganda to ease credit access as well as limit multiple borrowing.

Mr Japhet Aritho, the Airtel Mobile Commerce managing director, said the partnership will empower more people with access to credit, which is a key “catalyst for growth and development”.

However, Uganda Bankers Association cautioned Airtel and GnuGrid to be vigilant in protecting user data as well as ensuring that users credit scores are not compromised.

“Safeguards around data protection, minimising risk of manipulation and others will be important so that as lenders take out money, they can rely on [the solution],” said Mr Wilbrod Humphrey Owor, the UBA executive director.

Micro loans continue to be a subject of high interest rates.