MTN says the separation of the mobile money business from the listed company seeks to attract third-party capital and partnerships. Photo / File

MTN Uganda has indicated it has sought approval from its board to separate the Fintech business, which includes mobile money, from its stock portfolio.

The separation, which is being spearheaded at Group level, MTN says is part of its Ambition 2025 that seeks to reposition assets across Africa “to build value and attract third-party capital and partnerships” into its Fintech and infrastructure businesses.

“MTN Group is consolidating its infrastructure assets and platforms across its entire Africa footprint to ... attract third-party capital and partnerships. In Uganda, this includes the phased managed and structural separation of MTN Uganda’s financial technology [Fintech] and fibre businesses,” MTN said in a notice, in which it also announced the sale of unsold shares from its initial public offering (IPO).

The telecom had initially, in October 2021, listed MTN Mobile Money as a subsidiary of MTN Uganda, and was part of the initial public offering, in which it floated a 20 percent stake in one of Uganda’s most profitable companies.

MTN has since November 2021 traded as a single unit but now indicates that “the separation of the financial technology and infrastructure businesses will be undertaken on an arms’ length basis” and will ensure equitable treatment of minority shareholders, which means that existing shareholders will continue to benefit from proceeds generated from mobile money, but under a new structure.

Monitor understands the proposal is yet to be approved by the MTN board in Uganda, pending presentation of a suitable transaction structure.

MTN will follow Airtel, which last year excluded its mobile money unit - Airtel Commerce Uganda - from its initial public offering.

Mobile money and telecommunication services are run as separate companies, having been separated by the National Payment Systems (NPS) Act, 2020, with mobile money regulatory roles placed under Bank of Uganda, while telecom services were placed under Uganda Communications Commission.

Telecoms generate the largest share of their revenues from voice services but continues to see growth in new revenue streams such as mobile money that cover up declines in voice incomes.

For instance, in the period ended December 2023, MTN generated 29.3 percent of its Shs2.2 trillion revenue from mobile money, which earned Shs771.6b, and returned a net profit of Shs202.8b.

The figures above illustrate the importance of mobile money to MTN and its separation from the listed company will be a key factor in how the stock price moves when the telecom returns to the exchange after closure of the offer, in which it is seeking to sell 1.57 billion unsold shares.

MTN, which remains one of the most active stocks on the USE with a share price of Shs170 but below the Shs200 IPO price, last week suspended trading of its shares, pending closure of the offer on June 12.

The separation is also likely to impact MTN’s market capitalisation, which, at Shs3.81 trillion, makes it the most valuable company at the Uganda Securities Exchange.

Telecoms continue to be blue-chip companies due to their strong cash flows and generous dividend policies.

But the exclusion of one of the most important revenue streams could turn into a sticky issue, going forward.

However, last week, Ms Sylivia Mulinge, the MTN chief executive officer, said the company “takes great care to protect minority shareholders,” many of whom are within the 20 percent IPO band.

Last year, investors, both retail and institutional, stayed away from Airtel’s initial public offering, which was undersubscribed by 45.5 percent.

A stock analyst familiar with the separation, but spoke on condition of anonymity, said the proposal will only alter the company’s business structure and not shareholder returns.

The telecom, he said, will establish a “shareholder trust” to hold the MTN mobile money shares on behalf of existing shareholders.

“The trust is going to keep a register of investors who had invested in MTN Uganda when it was one unit. Now what happens is that whenever this trust receives dividends, it will distribute them to these shareholders,” he said.

Analysts have also indicated that MTN could be looking at listing the mobile money business as a separate entity either on the local or international market.

MTN chairman Charles Mbire (centre), rings the bell at the listing of MTN shares on the USE in November 2021. Photo / File

Growing influence of Fintechs

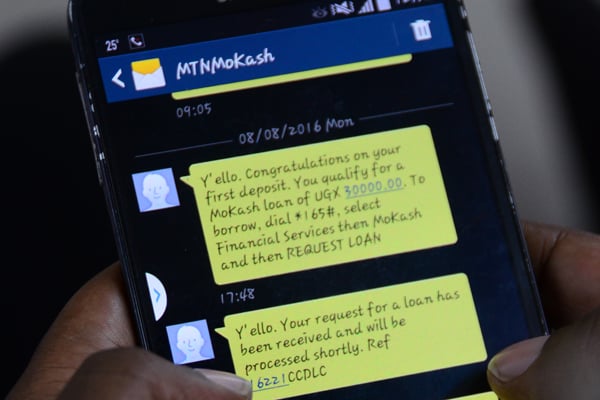

Mobile money remains one of the fastest growth markets with the potential to build a transaction chain that includes money transfers, payments, savings, and lending.

For instance, microloans have become a key factor in financial inclusion, through which MTN has indicated, that it will by the end of this year, target to lend at least Shs1 trillion to users.

The telecom has also indicated that it is innovating several products such as merchant loans that will take mobile money away from its traditional functions to becoming a financial suite.

Digital currencies and blockchain technology have the potential to transform the global economy and financial systems by increasing transparency, improving access, allowing deeper automation, and lowering the cost of financial products and transactions.

It’s because of this that large multinational payment giants are now rushing to get stake of such companies.

Early this year, MTN Group president and chief executive officer Ralph Mupita said MTN Africa values its Fintech division, MTN Mobile Money (Africa), at $5.2b with 72.5 million active users. MTN has even sold some minority stakes to Mastercard for $200m and plans to sell 30 percent of its stake in mobile money before the year closes.

For $550m, Airtel Money’s parent company, Airtel Africa, also sold a 25.77 percent stake in its collective mobile money business in 2022 now valued at $4b.

Airtel’s financial report shows that Airtel Mobile Commerce Uganda generates Shs737.1b, from which it turned a profit of Shs249.9b for the period ended December 2023.

On the other hand, MTN Mobile Money generated Shs784.4b and returned a profit of Shs202.9b in the same period.