Prime

MTN targets to lend Shs1 trillion in mobile money users with business loans

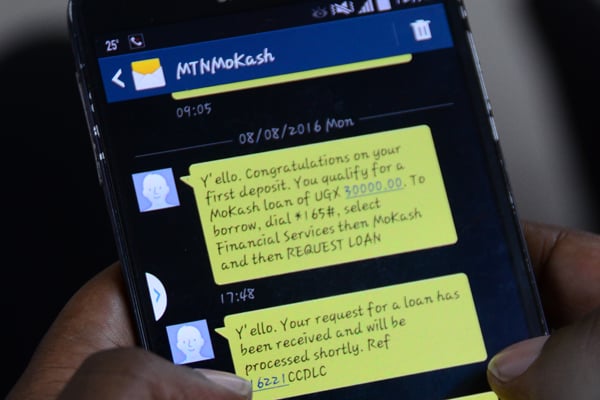

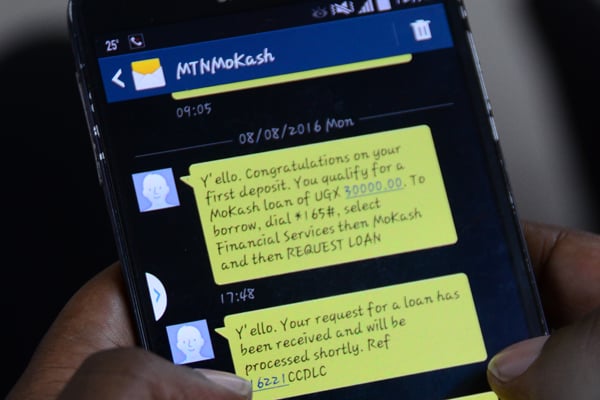

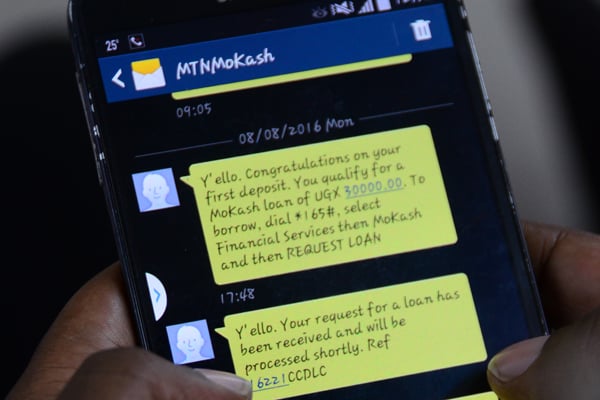

Mobile money credit has been growing reaching a monthly disbursement of at least Shs31.44b, according to Ministry of Finance. Photo / File

What you need to know:

- MTN says it will this year double mobile money lending from Shs550b to more than Shs1 trillion

Telecom giant, MTN, has said it will this year double down its mobile money lending with the view of advancing subscribers more than Shs1 trillion in micro loans.

The target is double the Shs550b, which MTN at the weekend indicated had been advanced to customers in the period ending December 2023.

It is also within and above what some big banks have projected to lend out in a period when many financial institutions continue to be cautious about lending to a section of customers, especially micro borrowers, many of whom are considered risky due to an increase in default rates and reduced ability by many borrowers to repay loans.

Responding to a range of questions at the weekend, Mr Richard Yego, the MTN Mobile Money managing director, told Monitor that whereas focus had been on personal loans that cater to things such as paying school fees, bills payment, and personal expenses, among others, this year MTN will, in addition to existing products, roll out agent and merchant loans that will largely focus on providing working capital and stock financing.

“This year we are coming strong on loans. Last year we did lend over Shs550b. This year we are targeting over Shs1 trillion. We plan to boost our loan portfolio with business financing by rolling out agent and merchant loan products for business [working capital and stock financing]. We want to support business growth,” he said.

However, Mr Yego did not indicate when this will be implemented but noted that MTN had already partnered with several financial institutions, among them KCB, NCBA, Post Bank, and Jumo through which the planned Shs1 trillion will be disbursed.

MTN mobile money lending has been growing by an average of 10 percent in the last five years, signaling an increased need for alternative sources of credit.

For instance, MTN reported that during the period ended December 2022, at least 945,185 mobile money subscribers had borrowed Shs401b, which is a 30 percent increase from the Shs261b registered in the period to December 2021.

Mobile money continues to play a pivotal role in easing access to credit, which for a long time, had been tied to financial institutions, savings and cooperative societies, and money lenders, among others.

A report by the Ministry of Finance last year indicated that mobile money loans had grown to a monthly disbursement of Shs31.44b, which was largely lent out on short-term with repayment periods ranging between 14 and 30 days.

Such loans, the Ministry also noted, carry a monthly interest of between 8 percent and 12 percent.

Government continues to take interest in mobile money lending given the pivotal role it is playing in private sector development.

The Ministry of Finance also said that mobile money credit had created an alternative for micro borrowers, many of whom are non-collateralised, noting that this reflects the benefits of digitising the economy and underscores the potential for growth in this area.

The Ministry also reported that with an approval rate of above 95 percent, mobile money was now contributing at least 2.9 percent to the total amount of loans extended to the private sector, which at the time stood at Shs1.08 trillion.

New revenue stream

Mobile money loans have also become a revenue stream for electronic money operators with telecoms being the biggest beneficiaries.

Telecoms continue to roll out credit facilities, among which include MTN’s MoKash and MoSente, operated through NCBA and Jumo, respectively, while Airtel operates Wewole, which is also operated by Jumo, among others.

MTN recently indicated that whereas credit applications had slowed in 2021 due to poor repayment, they have since 2022 recovered and are projected to grow further.