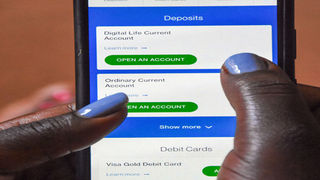

A customer opens a bank account online. If your next of kin is not a signatory to your account, and you don’t have a written will to determine that person’s legitimacy, the person will not have access to that money when you die. PHOTO/Michael Kakumirizi

|Prosper

Prime

‘Next of Kin’ is not an automatic beneficiary

What you need to know:

- ‘Next of Kin’ as indicated on the bank documents does not make someone an automatic beneficiary to the bank holder’s money in the event that they die.

- In case of death, your property can only be accessed by someone who has letters of administration, in case you did not leave a will or a grant of probate beneath the will.

‘Next of Kin’ as indicated on the bank documents does not make someone an automatic beneficiary to the bank holder’s money in the event that they die. The easiest way to pass money to your heir is by making them a signatory to your account.

Often when opening up a bank account, there is a blank space left to fill our ‘Next of Kin’ details. A research conducted by Prosper magazine, on what many account holders understand by ‘next of kin,’ shows that many believe that is the automatic beneficiary to their money in case they pass on.

According to Mr Elison Karuhanga, an attorney at Kampala Associated Advocates (KAA), in law, a ‘Next of Kin’ can be a person’s closest living blood relative or confidant who may be contacted in case of an emergency or death.

However, the term ‘Next of Kin’ as indicated on the bank documents does not make someone an automatic beneficiary to the bank holder’s money in the event that they die.

Explaining that in case of death, your property can only be accessed by someone who has letters of administration, in case you did not leave a will or a grant of probate beneath the will.

Counsel Karuhanga says to access the deceased person’s money, you have two get both documents that are letters of administration or letters of probate from the High Court. Unless the estate is very small worth a couple of million shillings, then you get the documents from a magistrate’s court.

He says the process of accessing these documents is a little hectic. “You deal with the office of the Administrator General, they give you a certificate of no objection after you proceed to the High Court and make an application for letters of administration.”

“Where there is a will, you take it to the High Court directly, and the Family Division of the High Court gives you a grant of Probate. They handle those things pretty quickly,” counsel Karuhanga says.

Other than that, Counsel Karuhanga says, the challenge can be if there is no will, then the Administrator General of Uganda, will have to order for a meeting with your people who are still alive, to see how they can be organised. Based on the resolutions from the meeting, the Administrator General, will give you letters of no objection.

He says if, however, there are some disputes within the family and no one can agree, then the estate will be administered by the Administrator General. He is the one who will have access to the deceased’s account and decide on how to divide.

Daniel Babonereirwe, the executive director BANAR Consults Limited, says in Uganda, the banks must oblige with the law.

Babonereirwe notes that ‘Next of Kin’ is the sort of person who can represent you in anything. But may not necessarily be a beneficiary.

“For example, when I am filling my forms, I put my brother as the next of kin, because he can indelibly defend my rights where I am not. But the beneficiary may be my wife and children,” Mr Babonereirwe says.

Mr Babonereirwe asserts that in case of your death or any disability, as long as the person is not a signatory, they never even access that money. Insisting that the best way to leave your money to a specific person, is by opening up a joint account.

Putting someone as a signatory to your given account is the best thing to do if you do not want to be disputed. However, to access that money as the ‘Next of Kin,’ you need a resolution from the courts of law or a letter from the Administrator General, indicating who is going to take over.

“I have witnessed quite a number of scenarios, you find someone has died and then someone comes in the bank, saying this person had money. So that person is reclaiming that money,” Mr Babonereirwe says.

Furthermore, Mr Babonereirwe says in other cases when you have a loan, the ‘Next of Kin’ can be accessed in case you are not available, but he/ she has no legal right to automatically inherit what you have.

He says the best the ‘Next of Kin’ can do for a bank is in case a person defaults on a loan, he or she can help you trace where that person is. In case the ‘Next of Kin’ does not help you trace the person, he has no case to answer.

He noted that if you default on clearing a loan and you are nowhere to be found, if a bank notifies your next of kin, how much you owe it, you cannot fault it for not being confidential, your ‘Next of Kin,’ is a trusted party with your information.

Mr Babonereirwe says the easiest way to pass money to your heir is by making them a signatory to your account.

“If you are a signatory and someone has passed on, you can actually access that money without necessarily having to bring any other document. But that is if it is a joint account,” Mr Babonereire.

However, if someone appoints a signatory to their current account, if the bank is notified about the death of the account owner, the rights of the signatory expire with immediate effect.

But, if demise is not yet known by the bank, then the signatory can access the money. Once banks learn of the account holder’s death, they put a halt on access to that money.

Whoever wants to access that money, must prove that they have the right and whoever appears to claim, the bank requests them to bring letters of administration.

Mr Babonereire adds that if you have letters of administration, then the bank endorses you to access the money that was due to that person, you can become a signatory, you can withdraw that money, close the deceased’s account and open another on which to deposit the money in your name.

He notes that the biggest conflict comes in between children or when someone has more than one spouse. Once you have a joint account even if they take a loan, either of you or both can sign to withdraw.

Explaining that even the liability is for both of you. When one takes a loan, the account commits both of you.

Another person cannot come in to say that money was for our husband or wife the moment he/she is not a signatory to that account.