Protecting family wealth with trustees

A piece of land in Luzira. If a family has a lot of land and wants to maintain it for a common use, the best system would be a family trust.

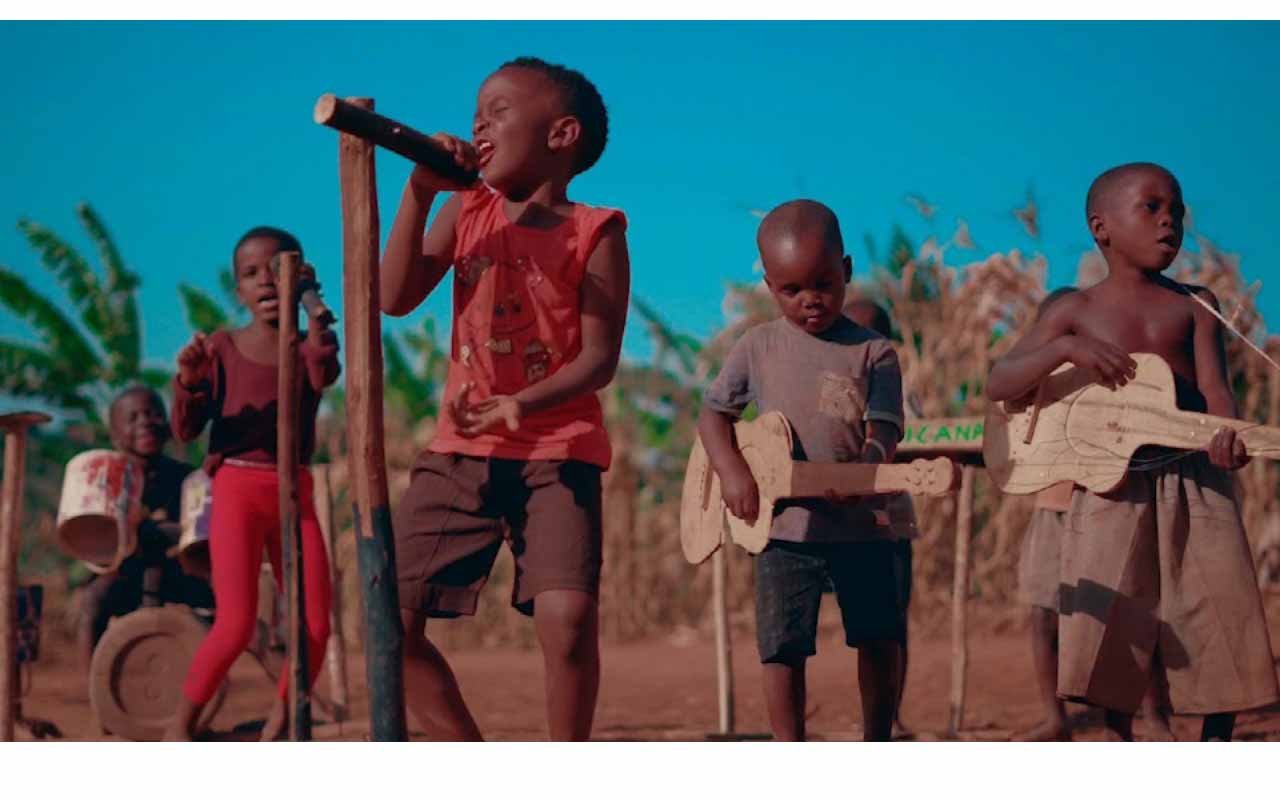

PHOTO/MICHAEL KAKUMIRIZI

What you need to know:

- A family trust because it holds better protection for any form of management to avoid loss of property.

When it comes to planning for an estate, many people write a will to have their property distributed, when they pass on. But many forget that there is another aspect.

Unlike a will which encourages division of both immovable and movable property, a trust encourages union and normally appointment of a trustee or trustees is on merit and family connection.

According to Mr Arnold Nogan Kimara, an attorney from Kimara Advocates and Consults, a trust is legally defined as an arrangement whereby a person known as a trustee holds property as its nominal owner for the good of one or more beneficiaries.

He says in a trust, a responsible person is appointed in a nominal capacity. That may be one individual or more than one who in this sense will be a board of trustees.

Counsel Kimara notes that on a scale of 1:10 the family trust is the best way that an extended family can hold together their property and keep it in a way that every member of the family can continue benefiting from it.

Explaining that this is a very good structure where the person or people making the trust, have vast property and the beneficiaries are also many. They may even be few, but not legally capable of fighting for their rights. That is where the trust helps.

“The key role of a trustee is to hold property and manage it for beneficiaries of the trust. So in every trust, there is the one that appoints the trustee. It may be a group of people whether charitable, social group or any other group of persons. For a trust to exist, there must be beneficiaries to the trust. Legally, the role of a trustee is to ensure that they look out for the benefit of the beneficiaries,” Mr Kimara says.

A trust is another way in which a family can structure their system. That is unlike a will that can easily be altered or challenged in court. For a trust the minister scrutinizes it before issuing certificates to trustees.

Family trust

A family trust, Mr Kimara says, is a legal arrangement set up by a family or a member of a family, appointing a group of persons or an individual to take on the role of trustees, whose sole duty will be managing the property of either that family for a member of the family and hold it in favour and for the benefit of the beneficiaries.

Oftentimes, the appointed trustee doesn’t even obtain any benefit. He may be a responsible member of the family, someone who holds a reputable office or someone the family holds in a respectful capacity.

The process

If it is a group of people appointing a trustee or trustees the family can convene a meeting and appoint a family trustee or trustees. When they do that, minutes will be taken down and people present will write their names, sign against their names and there will be communication from the chairperson communication why the meeting, the purpose for which everyone is going to be sought to give their vote and then the issue is tabled before them.

They tell the family members that there is a need to appoint a trustee and or trustees and then they will take a count on those who agree with the person or persons nominated and those who disagree. It may either be democratically or unanimously decided.

A trust is very good where the family has a lot of property and they do not intend to sell or divide it. Many times under a will, the practice is that the person who is making the will distributes it completely.In a trust setting, let’s say any elderly member of the family has a lot of land and wants to maintain that land for a common use, the best system would be a family trust because it holds better protection for any form of management to avoid loss of property.

When this family appoints an individual as a trustee or a group of people as trustees, the resolution is recorded down and at the end of the meeting, everyone present will sign agreeing to the resolution that has been made and to those that have been appointed.

However, at that point, they are only at the beginning step, when they appoint the trustee or the trustees, those appointed have a duty to apply to the Minister to be registered as trustees of a given family.

At the point where they are appointed by family, they are literally people who have been approved to become trustees but the trust is not yet established. They must take a step to draft what is called a trust deed.

This trust deed is the form of an instrument - a document that states what this family is, the members and may be to what clan they belong, who has been appointed, and how may one lose their role as trustee. They also discuss meeting of trustees, the properties to be administered in the trusteeship and the name of the beneficiaries to the trust.

They also name how that property will be managed. Will it be distributed when a child or a member attains a certain age, academic qualification or when they are married? Or will that property be maintained? The trust deed will state that these shall be maintained and will never be altered.

Mr Kimara says in the event that one person ceases to be a trustee, the trust deed must also state how a new member is added to that trust. These trust deeds have a general format but other items might be added in there. Like how often do they meet and when may this trust be dissolved. This must be indicated in that trust deed.

“You may choose and say if the purpose for setting up the trust has been fulfilled. Let’s say it was to hold the property for the benefit of the minors until they attain the majority age and are able to decide for themselves. Or if they each attain the age of 20 years,” Mr Kimara says.

“When they attain that age, the trust can be dissolved, the purpose for the trust will have been fulfilled. There will not be any further need for the trust to continue. So, when each of these is reduced into a form of a trust deed, the trustees nominated by the family, will file an application with the Minister of Lands Housing and Urban Development and will attach a copy of the minutes from the family which appointed them as trustees,” he says.

When they are registered by the minister, the minister issues a certificate stating their names as the registered trustees of the family. At that point, that group of people or that person, who now constitute the trustee or trustees, legally become sole representative and sole administrators over that entire property, if it is to manage property.

These trustees become the only legal people to sign any document and only legal people to run a bank account if it is related to that property being held under the trusteeship. No other member of the family will be legally permitted to engage or commit themselves on any of those properties.

How a family trust works

According to Mr Kimara, the family trust will work typically in the format of an inventory created because in the trustee deed you have all these duties spelled out. What are the duties of the trustee? Is it to collect rent, register unregistered land or is it to manage and repair commercial property.

He says all those duties are set out depending on the nature of property to be managed. When it comes to a family trustee, the middle thing must be property. It cannot be a trust to manage people, it is literally managing property in the best interest of the beneficiaries.

Mr Kimara says the trustees have things to follow; the trust deed, not to violate any provisions. Whether it is in reporting, updating the family and accountability.

Most trust deeds have accountabilities, if it involves managing and collecting monies from property, the requirement is to account to the beneficiaries. This is in terms of how the property is in good legal status, that is to say, it has not been lost. If there is any possibility of infringement, they fight for those interests of the beneficiaries to the trust.

When the trust is created, beneficiaries simply wait for their interest to be secured. The bigger job lies with the trustees, they have to hold regular meetings as trustees that is if it is more than one person. They have to hold family meetings and update the family.