Prime

How banks can lead fight against fraud

Gideon Nkurunungi

What you need to know:

- Developing predictive models or understanding data on fraud is going to set new standards in the fight against financial crime.

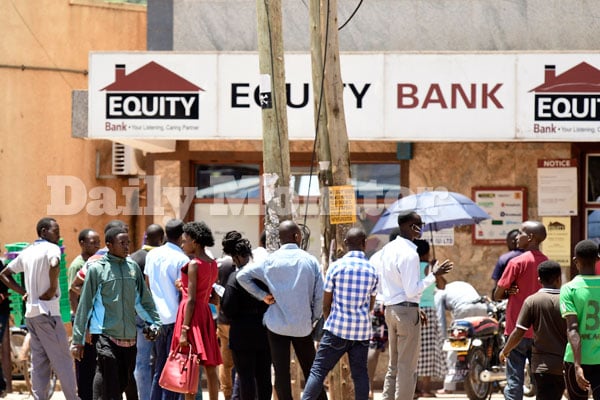

Banks in Uganda are taking the lead in combating fraud to help protect customers’ hard-earned money. Some of these concerns have been expressed with sentiments by members of the public.

However, more caution is needed to protect assets and client personal information as the banking industry continues with the fight to combat the increasing fraudulent acts that pose a threat to individuals, companies, and financial institutions. More vigilance and a multifaceted approach by financial players and stakeholders are required to safeguard assets and client personal information.

ICT Association of Uganda (ICTAU) is championing a pioneering approach powered by researchers and partnering education institutions in exploring practical techniques on utilising behavioural data analysis to predict fraudulent activities.

The Uganda Bankers Association (UBA), Uganda’s umbrella organisation for banks, recently pushed for harsher punishments for individuals involved in financial fraud, citing a rise in fraud in the financial services sector.

Global technological advancements have made bank fraud acts increasingly possible and easy for criminals to have a playfield as these are now able to skim or clone realistic counterfeit and fictitious cheques, plastic cards plus identification tags that can be leveraged to defraud banks. However, all these advancements offer a beacon of hope through AI and machine learning.

Developing predictive models or understanding data on fraud is going to set new standards in the fight against financial crime.

In 2022, fraud was recorded at 438 percent in Kenya, 174 percent in Nigeria, and 144 percent in South Africa, according to Kaspersky Africa. The rise indicates that despite banks tightening their fraud-protection systems, adding two-factor authentication, binding bank accounts to one digital device and even to one SIM card serial number, and introducing daily transfer limits, the increased level of automation and digitisation continues to expose customers and organisations.

Regulators Guidelines

To address financial institution fraud, the Bank of Uganda (BoU) highlights the various ways for the public to reduce and eradicate fraud, as there’s no single mechanism but rather a comprehensive approach and range of tactics to be deployed.

BoU cautions customers and banks to regularly exercise due care when handling cheques. As well, customers are highly encouraged to showcase due diligence, as the banks have to put up robust systems, procedures, policies, and guidelines to mitigate fraud.

Part of BoU’s initiatives to sustain a safe financial sector includes strengthening the regulatory framework and putting in place high supervision of all financial institutions. As a result, new laws have been enacted, including the Microfinance Deposit-Taking Institutions Act 2003 (MDI), the Financial Institutions Act 2004 (FIA), and the Foreign Exchange Act (FEA). These were enacted recently to ensure financial institutions are managed within the legal environment on a timely basis.

Lastly, the regulator regularly meets with the Uganda Bankers Association to discuss fraud and forgeries taking place in the financial sector, and ICTAU stands ready to contribute practical, technologically advanced solutions to these discussions, solutions that are born out of deep engagement with development partners and leading academic institution.

An Economic Intelligence Unit has been established at the central bank to handle issues of fraud and forgeries taking place in the financial sector. Also, the payment system is modernised, courtesy of tBoU’s partnership with financial institutions.

However, the persistent and evolving threats banks face today necessitate broader collaboration, particularly the unique technical insights and advanced research capabilities. Only through such inclusive partnerships can we truly fortify our defences against the sophisticated fraud challenges looming on the horizon.

Mr Gideon Nkurunungi is the CEO of ICTAU, and a researcher in Predicting Behavioural Malware at Makerere University