Prime

Uganda, Loans, The Future

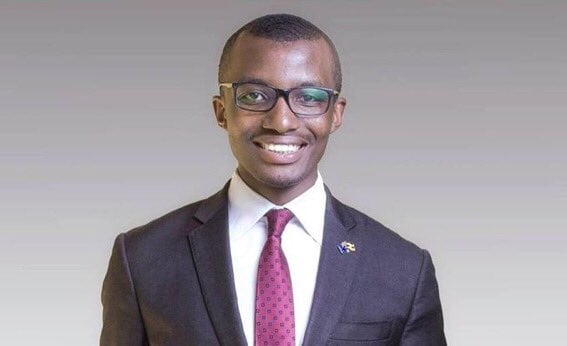

Raymond Mujuni

What you need to know:

This reputation – the one of not paying back money owed to us – is a dangerous reputation to carry in a capital world

You have to have real gonads of steel, measured in their tonnes, to lend in Uganda or deliver on any work unpaid because everything right from carpenters to mezzanine funds and banks require some form of fight to recover money lent or payment for work done recently.

This reputation – the one of not paying back money owed to us – is a dangerous reputation to carry in a capital world. Money, you might have heard this before, is shy. It abhors noise, disruption and loss. We cannot afford as a young economy driven by small and micro enterprises to have no capital to lend, or to play around with the little we have.

Which is why, the debt repayment situation in both private and public enterprises needs to be addressed holistically.

The primary problem in our capital markets is that there isn’t enough money to lend. In typical finance, banks, private funds and their attendant cousins are only able to lend based on savings. And since our local savings pool is so meagre, we ought to depend strategically on global savings pools to get much needed finance. The role of our financial architecture – and those who run it - thus, is to get the cheapest possible finance which, for clarity, is; long term, large money, with low interest rates and in-built grace periods.

The Mezzanine fund that Simba group of companies got met and ticked most – if not all – of the variables here. It was $10mn, with impressive grace periods that were negotiated and renegotiated more than once, it also had low interest rates. The problem though, was that the projection on which the repayments was based on suffered a major flaw. Simba group of companies had hoped, that the Ugandan government would stick to it’s word on getting the oil to flow and the economic activity that would follow it would trigger spending which would make the Skyz Hotel a viable entity.

Lodging and accommodation in Uganda suffered it’s problems with COVID19 lockdowns first and later with global economic decline and as such the hotel wasn’t spared. I have written before, here, that Simba group is to be understood – not mocked. This doesn’t mean that Simba shouldn’t pay it’s debt – it should and do so fast.

It is government, its bureaucracy and decision making that should be on the judgement board. Governments are large bureaucracies with definite procedures because one of the principle aims of that is to make them predictable in decision making. Because of that predictability, governments can borrow – immensely at lower rates because savers lending to government know that they will always be repaid. When governments, however, move to make private sector the driving force of their economic development, they then have to create the conducive environment for the private sector to grow. That environment inculcates policies, culture, sanctions and programs. We really ought to ask, when, in definite terms, will the oil flow from the ground? Answering this question means that private sector can start to build around such hugely expected revenues. If that question remains to be answered by the whims and emotions of people and not predictable behavior, then the entire well is poisoned downwards creating more Vantage capitals and Simba Groups or if you like; Hams and DTBs, Mbiddes and Marthas.