Prepare your Will to fortify your legacy

Shane Musanase

What you need to know:

- A Will may be modified from time to time as circumstances do change such as marital status, children, death of beneficiaries or executors, disposal of assets to mention a few.

As we come out of the fear of loss of life due to the Covid-19 pandemic, I implore us not to forget the very important lessons that come from hardship, anxiety and change.

A week or so before the nation was locked down, I lost a family friend in a car accident and as we laid him to rest and said our good byes. I thought about his brilliant legacy.

In the days that followed, I carefully watched his wife and children pick up the pieces and I found myself learning about a prudent man who guided his family to carve out the family vision in January 2020, a few months before his demise.

I discovered his openness and commitment to share his dreams and ideas with his loved ones constantly reminding them of their responsibility to pursue hope and a future.

His plans, investments and direction became the wisdom they needed for stability and continuity in his absence.

My late friend and I had discussed at length that a Will was one of the most important things to leave in place for it legally protects your spouse, children and business interests by laying out clear responsibilities and management of your estate.

During the lockdown, I shared this important reality with a few people requesting them to ponder on this question; “How do I put my house in order?

Preparing a Will

Wisdom demands that we follow the footsteps of the wise. I believe that God gave man His Will when He authorised him to take dominion and manage his creation. History also makes reference to how wealth has been passed on from one generation to another.

In these changing times, a prudent person should prepare his/her Last Living Testament carefully thinking about legacy, protecting your family to avoid potential family disputes, allocate responsibility of minor children or incapacitated dependents and business and investment continuity.

One should also consider estate planning and training of the next generation, beneficiaries of the estate as well as how they shall receive or discharge their duties.

Look out for trustworthy executors who will carry out your instructions as stated in the Will, debt(s) and how they may be managed, trustworthy persons to witness your Will as they shall be called upon after your demise to verify that whatever stated therein is a true record of your last wishes and safe custody of your Will.

A Will may be modified from time to time as circumstances do change such as marital status, children, death of beneficiaries or executors, disposal of assets to mention a few.

Amendments or updates to a Will may be recorded in what is referred to as a Codicil.

With all the benefits of a WILL, why delegate your authority to others to put your affairs in order?

As I write this piece, I encourage you all to be deliberate to organise and educate future generations about dreaming, planning, purpose, family history, faith, values, lineage and culture.

Simply look at a Will as your final love letter or a fantastic business plan for the beneficiaries of your estate to appreciate your life as you saw and how you most probably perceived it while you lived.

It is wise for you to seek legal counsel as you prepare your Last Living Testament so that your document is valid and ready for implementation after your death.

Celebrate life and its lessons by being deliberate to put your affairs and house in order by preparing your Will to fortify your legacy.

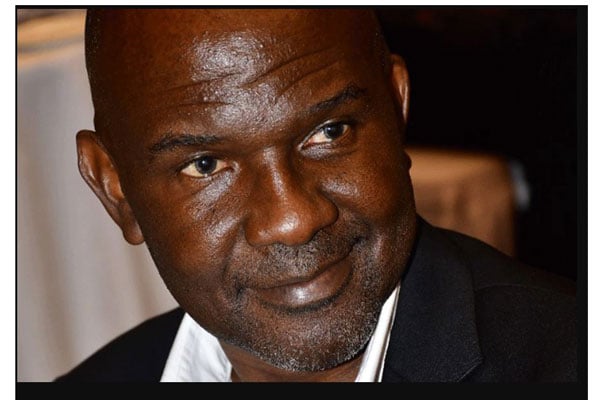

Musanase is a partner with Apio, Byabazaire, Musanase & Co. Advocates. [email protected]