Prime

NSSF tests pay system, midterm claims start

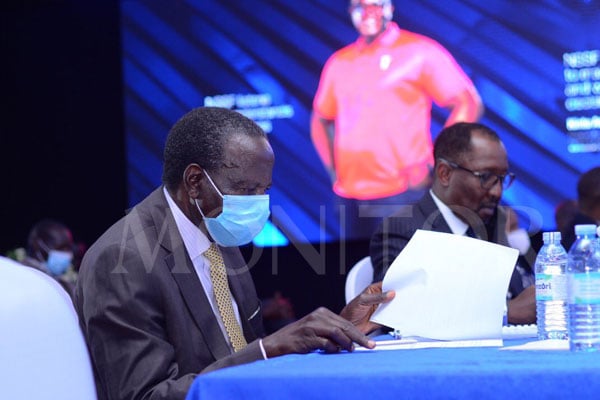

NSSF members line up at Workers' House in Kampala to apply for the 20 per cent mid-term access of their savings on March 7, 2022. The mid-term cash is for people who have saved with the Fund for 10 years and are above 45 years of age. PHOTO/ STEPHEN OTAGE

What you need to know:

NSSF management selected five potential beneficiaries, among them their staff, to trial the scheme.

The National Social Security Fund (NSSF) yesterday conducted a dry run to test the operational efficiency of the customised platform for processing midterm cash transactions.

Eligible claimants, among them members aged 45 or older and have saved for a decade, or persons with disability aged 40 and above who have saved for a similar period, will start applying to receive 20 percent and 50 percent of their benefits, respectively, today.

Yesterday’s system testing exercise at the Fund headquarters at Workers’ House on Pilkington Road in Kampala showed success, according to highly-placed sources.

This newspaper understands that NSSF management selected five potential beneficiaries, among them their staff, to trial the scheme.

Our investigations showed that after submitting their particulars, including information about the requirements, the individuals piloting the midterm cash access received an automated message on their mobile phone handsets, confirming successful application and a notification that the processing would take at most 45 “working days”.

The system feedback, referencing working days, appeared to contradict previous public proclamations, including by the Gender minister Betty Amongi that the period for processing the money could at most stretch to 45 calendar days.

Under the midterm access regulations gazetted last Friday, claims will only be processed on weekdays, excluding public holidays, and between 8am to 5pm.

The latest revelations that the 45 days reference means working days, implies processing of a claim could stretch into a third month.

In response to our inquiries confirming the yesterday’s test run and redefinition of the “45 days”, NSSF communications manager Victor Karamagi, said: “Let’s talk about that tomorrow (today). It’s the main subject the managing director (Richard Byarugaba) will talk about [to media fraternity] and we will take you [journalists] to witness the process and the technology that we are using [to process payments].”

Justification

Insiders told this newspaper that the Fund’s management last week discussed the potential that a likely overwhelming turnout of claimants could end in chaos, resulting in proactive arrangements for law enforcement.

Today marks the beginning of the last stage for savers who have anxiously waited to receive their money since the clamour for midterm access began with Covid-induced distresses in 2020, and two months since President Museveni signed the NSSF (Amendment) Act, 2021 into law. To apply, claimants are to fill a form and submit a form either in person or online.

In addition to the eligibility criteria set in the law, the rules require eligible savers to present/fill in details of a National Identity Card or Aliens Identification or refugee document, and an NSSF membership number alongside employment history records and, if a person with disability, a documentary proof signed by a medical or expert professional.

Eligible members also have to present a current passport photo. Savers have the options to be paid via a bank account, or mobile money, while persons living abroad can be paid in foreign exchange at the prevailing exchange rate.

NSSF says they have gazetted areas, including regional offices and Kololo Ceremonial Grounds in Kampala, and deployed adequate staff to handle the claims transactions starting today.

background

At last week’s press conference, Gender minister Betty Amongi said the Fund is set to pay out Shs50b per week for the first five months --- a huge cash release expected to increase household spend and economic activity. Savers also have the option of withdrawing their accrued benefits in instalments as agreed upon with the Fund, which prefers lumpsum payment to beneficiaries.