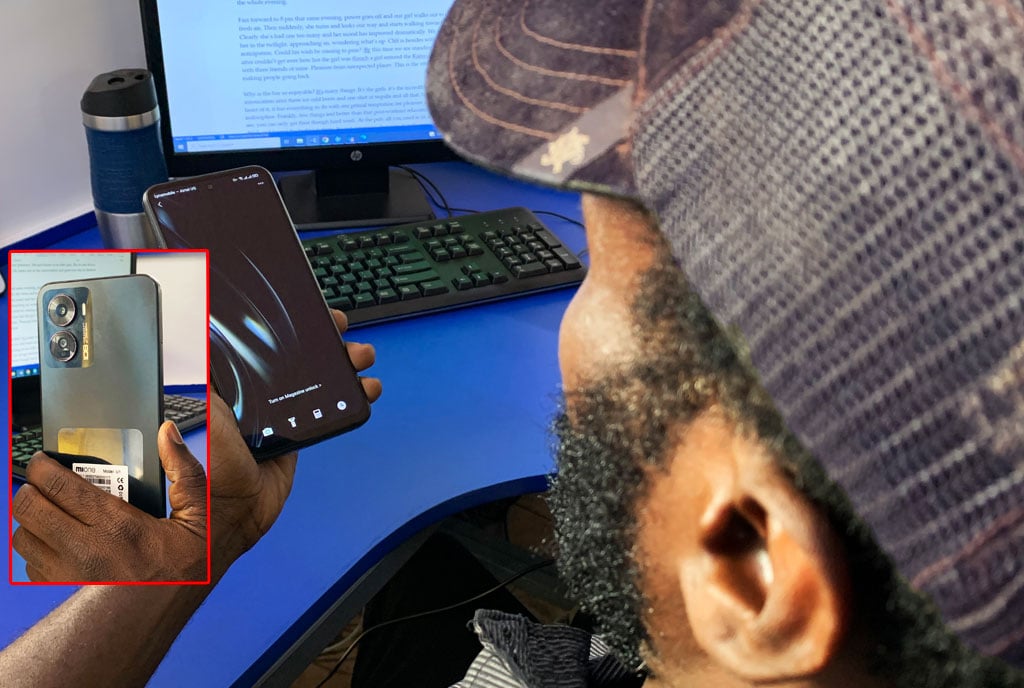

Financial results indicate that the year 2022 saw growth in banks’ incomes. PHOTO BY MICHAEL KAKUMIRIZI

|Prosper

Prime

Banks’ profits: A glimpse into the economy’s health

What you need to know:

- Most banks have found a way to keep ahead of the curve even when many other economic sectors are struggling to stay afloat. The five top banks in Uganda generated combined total income of Shs2.8 trillion and profit of Shs829 billion in 2022.

After two years of restricted economic activities, more than 75 per cent of companies across the economy did not just hibernate but went under— closed shop, according to available studies, including one conducted by the Economic Policy Research Centre (EPRC) at the peak of Covid-19 enforcement measures.

With just a year after lifting most of the Covid-19 pandemic restrictions, the banking industry emerged as the most profitable sector going by the profitability levels recorded by most of the 25 commercial banks currently operating in the country.

Financial results indicate that the year 2022 saw growth in banks’ incomes despite just a few that didn’t. Overall, most banks registered improvement in total assets.

The five top banks in the country generated combined total income of Shs2.8 trillion and profit of Shs829 billion in 2022. These banks include Stanbic Bank Uganda, Centenary bank, Standard Chartered bank, Absa Bank Uganda and dfcu Bank. These were followed by others like Citibank, Bank of Baroda, Diamond Trust Bank, Housing Finance Bank and Equity Bank, which made a combined profit of Shs316 billion.

The chancellor of Makerere University and Professor Ezra Suruma in a telephone interview with Prosper Magazine on May 3, said the quality of corporate governance, the degree of contribution of the shareholders, the size of the bank and their business models, are all crucial in contributing towards profitability levels.

According to Suruma, the increased profitability is also due to short term loans and the fact that many banks are investing in government securities which are profitable and risk free. The downside is that this model crowds out private sector who are involved in real wealth creation activities.

An agent banker prints a receipt after a transaction. Digitisation in the banking industry has started paying off as banks break away from banking hall services. PHOTO/ MICHAEL KAKUMIRIZI

Resilience

Following the full re-opening of the economy in 2022, leading to increased demand for credit, high customer deposit growth and the move to provide more targeted services helped banks to register a unified growth income.

The published financial results indicate that almost all banks registered an increase in their income. In telephone interview, the chairperson of Uganda Bankers Association (UBA), who is also the managing director of Citibank Ms Sara Arapta told Prosper Magazine that in 2022, banks in Uganda demonstrated resilience and stability, which is proof that they kept on lending despite the fact that the economy was not doing very well.

“In the financial year 2022, banks registered an increase in net interest income because they continued lending to support business recovery in the country. We did not hold back lending and that is why banks’ interest income grew,” she said.

When contacted, the banking industry regulator attributed the increased profitability levels to resilience of the sector built over the years.

“Uganda’s banking system has shown resilience in the current global financial turbulence,” the director research, Bank of Uganda, Dr Adam Mugume, told Prosper Magazine last week.

He continued: “The banking system is well-capitalised and profitability has increased. Banks continue to hold strong liquidity buffers, despite the tight funding conditions related to the monetary policy stance.”

The increased level of profitability wasn’t a surprise, according to Dr Mugume, considering improved aggregate core capital-to-Risk-weighted assets ratio (CCRWA) of the banks from 21.4 per cent in June 2022 to 24.2 per cent in March 2023. This simply means that domestic banks had a good bill of health and for that, there is no worry or risk of being overwhelmed by liabilities.

However, the profitability has in part, been driven by an increase in the interest income, which was a result of the increase in yields on government securities.

For instance, yields on 364 days treasury bills rose from 10 per cent in January 2022 to peak at 15.4 per cent in November 2022 before gradually declining and currently standing at around 12.5 per cent.

Similarly, yields on the two-year bond rose from 11 per cent at the beginning of 2022 to peak at 16.8 per cent towards the end of the year.

“This increase in yields was precipitated by the projected higher government borrowing from the domestic market before the Treasury substituted domestic borrowing with foreign borrowing,” Dr Mugume explained.

Sign of good times?

Although developments in the banking industry can provide a proper projection of the economic outlook, the registered improved profitability of most commercial banks operating in the country, for now, provides a partial picture. And here is why.

“Uganda’s economy is on a recovery path with growth of about 6 per cent in 2023 and this should continue to support the banking sector profitability and vice versa,” says Dr Mugume.

That said, there are headwinds in 2023 that might impact negatively on the banking sector.

Uganda is an open economy and intertwined with the global economy, “therefore whatever affects the global economy will eventually impact the Ugandan economy,” according to the Bank of Uganda.

“Currently, the global financial system is going through some turbulences, and this could spill over into the domestic market through banks being more risk-averse and therefore lending less than they would have done. This will impact on their interest incomes,” says Dr Mugume.

He continues, “Secondly, with the pronounced slowdown of the global economy, from global growth of 3.4 per cent in 2022 to the projected growth of 2.8 per cent in 2023, this could impact on Uganda’s economic growth and therefore partly constrain the vibrance of the banking system.

“Thirdly, with fiscal consolidation and a projected less government domestic borrowing, yields on government securities should decline and reduce interest incomes.”

A woman holds a bundle of cash in a bank. The quality of corporate governance, the degree of contribution of the shareholders, the size of the bank and their business models, are all crucial in contributing towards profitability levels. PHOTO/ EDGAR R. BATTE

Then there is also the issue of loan impairment and the fact that it is still lingering around, Dr Fred Muhumuza, a senior economist, is a tell-tale sign of what kind of an economy this is.

“Bank profits are heavily driven by lending to government. Also some big banks lend to smaller ones and that is where we are at,” says Dr Muhumuza.

But for Dr Mugume, non-performing loans (NPL) as a percentage of total loans which as of March 2023 stood at about 5.8 percent, slightly higher than 5.3 per cent in June 2022, is what he describes as “moderate NPLs”, saying is in part due to continued proactive write-offs. With economic recovery underway, NPLs should decline back to the historical average of below 3 per cent.

New normal or averse?

In another interview with Mr Mustapha Mugisa, a banking industry analyst, the Covid-19 situation was more of a blessing in disguise for most financial institutions.

According to the chief executive officer of Sumit Consulting Ltd, the Covid- 19 pandemic helped banks to deepen inclusion, enabling them to reach out to as many people as possible, many of whom were beyond their reach previously.

“Some of this growth is coming from the insurance sector by way of bancassurance involvement in the banking sector,” Mr Mugisa told ProsperMagazine in an interview last week.

He noted that banks are increasingly employing data analytics, helping them to avoid or cut costs that previously would be incurred.

With the pandemic, people were willing to work from home, reducing on huge overhead cost in offices.

With more use of technology, the banking industry will only continue to save on costs as opposed to spending on them.

The growth of banking industry profitability is also attributed to the expected oil and gas sector cash flows. This has been firmed with the secondary market critical role as banks are increasingly diversifying to government securities, implying banking industry cautiousness in lending to private sector and averting the risks of non-performing loans, “which has been a problem.”

As for the Mr Corti Paul Lakuma , a research fellow in the macroeconomics department at EPRC, the increased profitability levels are: “A good indicator that the economy is recovering faster than it was earlier estimated.”

However, he rhetorically notes: “You have to dig deeper into those statistics and examine the composition of bank profitability. How large is treasury instrument component? If it is large, then the banks’ profitability just shows that doing business with the public sector has been good in the foregoing year.”

Importantly, according to Mr Lakuma, if the private sector credit is large, then the economy is somewhat past the challenges posed by Covid-19.

And if the treasury instrument is large, then it is too close to call; because the public sector has the ability to spend even during a crisis.