Prime

Experts ask govt to waive taxes amid rising prices

A truck loaded with Matooke at a fuel station on Old Port Bell Road in Kampala recently. Fuel is among the key commodities whose prices have risen drastically in the past weeks. PHOTO/STEPHEN OTAGE

What you need to know:

- Experts say the move will promote local production of products whose prices have increased drastically.

Experts have asked the government to temporarily suspend taxes on crude palm oil to reduce the skyrocketing prices of domestic products, especially soap and cooking oil.

For instance, the price of a bar of white soap has risen from as low as Shs3,500 in December last year to Shs10,000 by yesterday in some parts of the country.

Government in July last year slapped a 10 percent import duty on crude palm oil, which is the most critical raw material for the production of soap and cooking oil.

Dr Brian Sserunjogi, an economist and research fellow at the Economic Policy Research Centre (EPCR), said whereas the rising commodity prices isn’t unique to Uganda, the government ought ‘to do something’ to save its people.

“Manufacturers of soap are saying the cost of raw materials, especially crude palm oil has increased. So if the government suspends the 10 percent import duty on this product, it may reduce the current cost of soap and cooking oil. It may not do wonders but at least it can make a difference,” Dr Sserunjogi said last week.

He said Malaysia, which is one of the biggest producers of crude palm oil, has put restrictions where all exporters have to reserve 20 percent for their domestic market. He said that constraint has affected global supply.

ALSO READ: War, inflation threaten world economy

Dr Sserunjogi also attributed the high prices of soap and cooking oil to heavy rain and shortage of labour in Malaysia, which he said has affected production of crude palm oil.

“But also the ongoing war between Ukraine and Russia also impacts crude palm oil. How? Ukraine and Russia produce sunflower oil and contribute about 85 percent production. So if they continue fighting, it means there that production of sunflower oil will be less and the pressure will be on the crude palm oil hence increase in its price,” he said.

“Therefore, this will require the government to step up efforts in salvaging the situation by suspending the import duty on crude palm oil as a short-term measure,” he added.

The executive director of Uganda Manufacturers Association , Mr Daniel Birungi, also agreed, saying the government must have discussions around taxes on items whose prices have shot up.

“While we need revenue as a country, we also need to look at some taxes that can be waived either in the interim or long term since our focus is on salvaging the current situation and also promoting local production. Why should the government impose heavy taxes on raw materials, which we don’t produce?” Mr Birungi wondered.

He proposed that government use diplomacy to engage with countries that produce crude palm oil to reduce taxes on the product.

“We can also have a discussion on buffer stocks because ordinarily, countries can withstand six months of lack of access to critical products in case of any crisis if at all they stocked enough products. Is Uganda ready for that? Definitely not. If not, then we identify those products that are critical to the economy such as soap and sugar and we say that as a government, we are buying buffer stock to avoid any eventualities like what we are facing now,” he said.

As a long-term measure, Dr Sserunjogi advised the government to support farmers growing oil palm to increase the production of crude palm oil.

ALSO READ: Don’t take Ugandans’ resilience for granted

He said what is currently being supplied by Kalangala to Bidco is less than 4,000 metric tonnes yet the latter has capacity to process at least 10,000 metric tonnes.

“If a country can be self-sufficient in producing raw materials, then we could handle the situation in future when a similar problem happens. Sugar prices can increase but cannot get out of hand because we produce raw materials for its production,” he said.

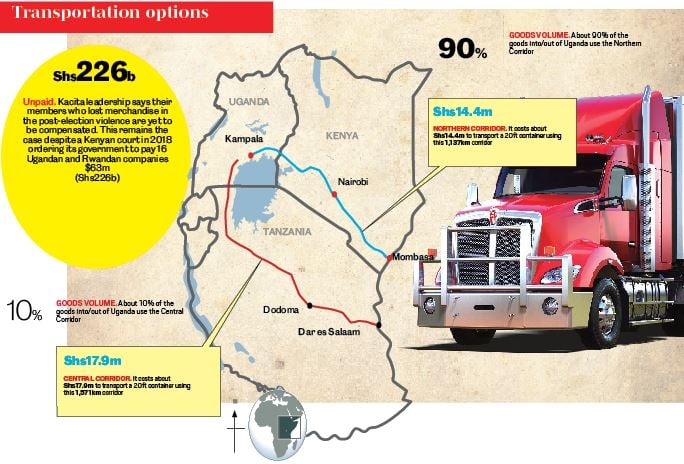

Dr Sserunjogi and Mr Birungi also said the government should fast-track the railway transport system to reduce the cost of transportation of products from Mombasa to Kampala and distribution within the country.

Mr Birungi said with railway transport, the government would significantly reduce the expenditure on maintenance of roads.

“We need to appreciate the fact that the Uganda Railway Corporation has challenges in rolling stock like tankers and container carriers, and if we address these, we would be enabling an easy transport system. So if we removed taxes on diesel, which is used by train, it will automatically reduce about 35 percent of costs on transportation of raw materials,” he said.

Asked whether manufacturers have engaged the government on how to solve the current crisis, Mr Birungi said the discussions are ongoing and that the latter has welcomed all the proposals.

Govt position

Finance Minister Matia Kasaija recently attributed commodity price escalation to geo-political tensions that have disrupted supply of oil and cereals.

He said the cause of increasing commodity prices are external and beyond the ability of policy makers to deal with.

Contrasting Uganda’s commodity-influenced inflation with America’s 40-year high consumer price index driven up to 7.9 percent in February, Mr Kasaija said the Central Bank is preparing policy interventions “to contain inflation within target and maintain macroeconomic stability.”